work from home equipment tax deduction

Home office equipment including computers printers and telephones. Its also possible to take.

Taxes You Can Write Off When You Work From Home Infographic Bookkeeping Business Business Tax Business Tax Deductions

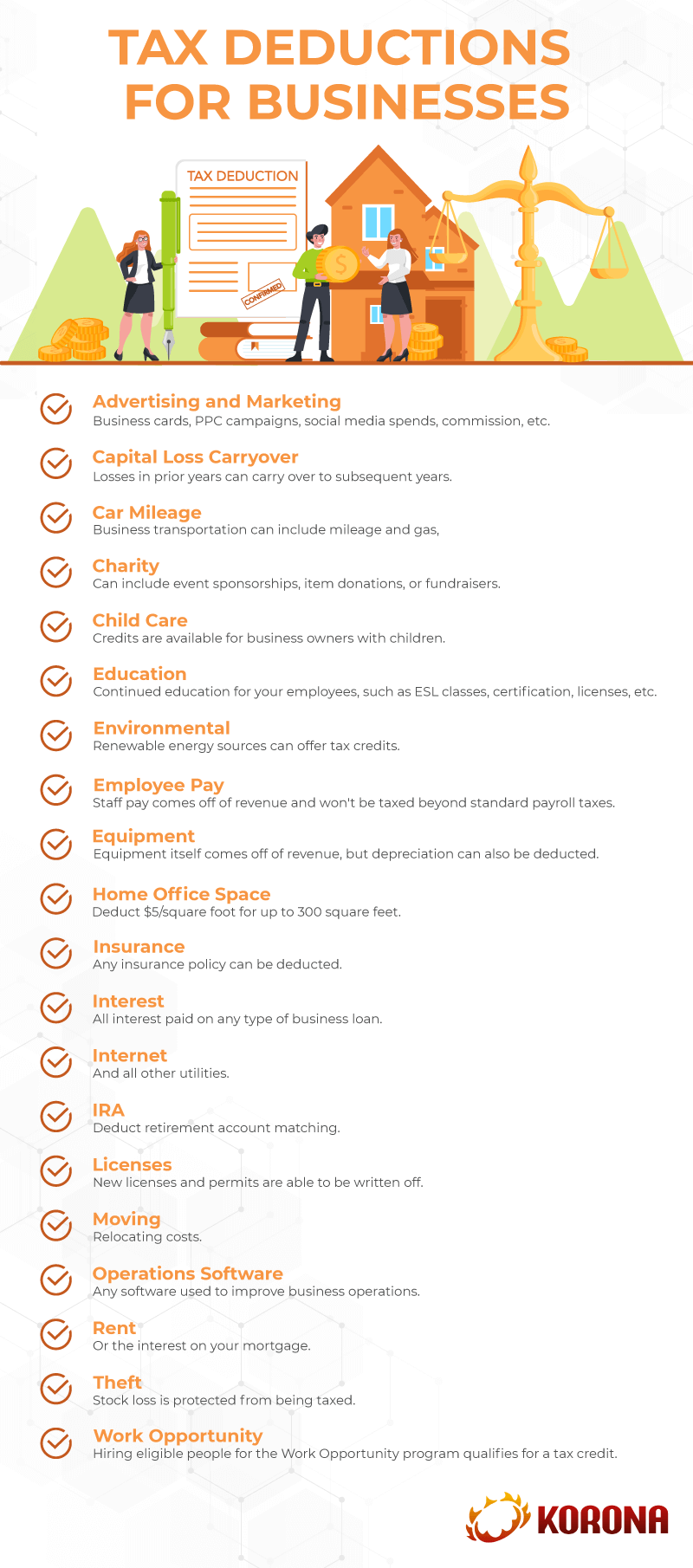

One of the bigger tax deductions you can take if you work from home as an independent contractor is the home office deduction.

. There are two ways that eligible taxpayers can calculate the home-office deduction. Payment or reimbursement to your employees of up to 4 a week 6 a week from 6 April 2020 is non-taxable for the additional household expenses incurred when your employee. This means you could claim a deduction of 256 when you lodge your tax return.

You need it to do your job you use the equipment for work and theres no significant private use - this includes using the equipment. This method allows you to take a deduction of 5 per square foot used for work up to a maximum of 300 square feet. Until 5 April 2022 you do not have to pay tax on it if the employee.

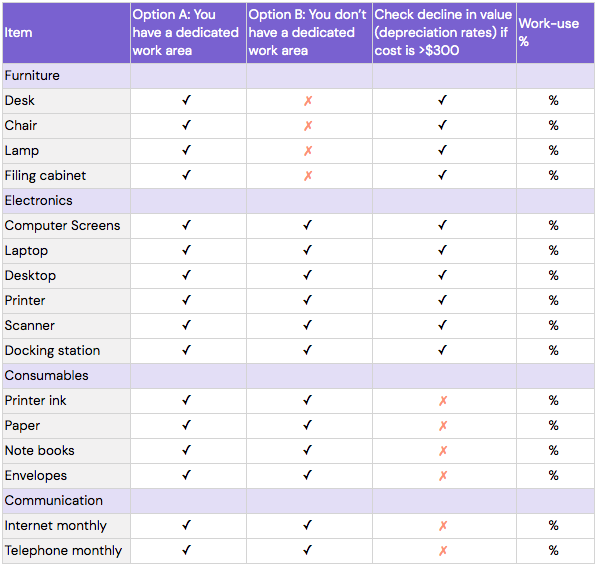

In the simplified version you can take 5 per square foot of your home office up to 300 square. Home office equipment including. You can only claim tax relief for equipment expenses if.

The following applies to technical work equipment such as notebooks or smartphones. Cleaning costs for a dedicated work area. This amount will be your claim.

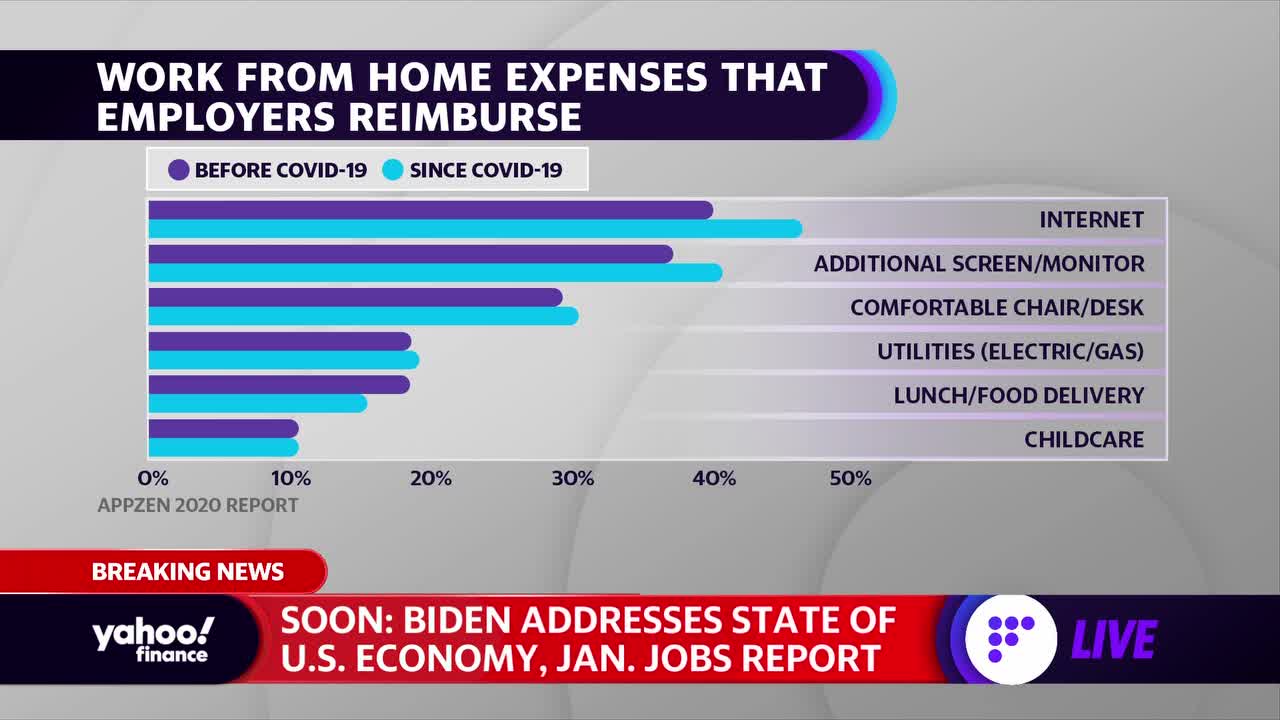

Equipment services or supplies you provide to employees who work from home for example computers office furniture internet access pens and paper. To take this deduction youll need to. Work From Home Tax Deduction Details.

If you are an employee who works from home and have set aside a room to be occupied for the purpose of trade you may be allowed to deduct certain expenses incurred in. 24918 10 5 months 12 months 1038. This method allows you to take a deduction of 5 per square foot used for work up to a maximum of 300 square feet.

Fill in the form. You need to work out the numbers for you. Count the total number of days you worked from home in the year due to the COVID-19 pandemic and multiply that by 2 per day.

Phone and internet expenses. All right but those of you working from home whether its permanent or hybrid you cant deduct the home office or any of the other related expenses bottom line. The maximum you can claim using the new temporary flat rate method is 400 200 working days per individual.

Tax deductions for expenses needed to work from home are. You can claim the full cost for items costing up to 300 or the decline in value for items costing 300 or more. For people filing for tax years before 2018 work from home deductions can be used.

These numbers are just examples. Tax deductions for expenses needed to work from home are. As Abdul can claim mortgage interest expenses as a.

There are two methods for claiming the deduction. Computer consumables for example printer paper and ink and stationery. Total occupancy expenses floor area percentage time used for work purposes.

The home office deduction allows certain people who use part of their home for work to deduct some housing expenses. You can reimburse your employee for equipment they bought to work from home because of COVID-19.

What Are Business Tax Write Offs How Do They Work Paychex

How To Claim Working From Home Deductions Kearney Group

Here S Who Can Claim The Home Office Tax Deduction This Year

Work From Home Here Are The Tax Deductions That You Re Missing Mcleod Associates

5 Home Office Tax Deductions You May Have Overlooked Article

Home Office Tax Deductions Checklist Do S And Don Ts Zdnet

Who Can Claim Home Office Tax Deduction If They Worked From Home

Home Office Deductions For Streamers Infographic

Deducting Wfh Expenses There Are Fewer Tax Breaks Than You Might Expect

Tax Deductions For Small Business Owners 20 Tips For 2021

What Is Remote Work Allowance A Guide To Tax Deductions Relief

Massachusetts Legislature Passes Legislation Enacting Work Around To Federal 10 000 Salt Deduction Limitation But Governor Baker Sends It Back With Amendment Don T Tax Yourself

Deducting Home Office Expenses Journal Of Accountancy

Are Llc Startup Expenses Tax Deductible Legalzoom

What Expenses Should My Employer Pay If I Work From Home

The Top Tax Deductions For Freelancers Forbes Advisor

What Is A Remote Work Stipend And Why Do You Need One

Video Can I Deduct The Cost Of A New Computer On My Taxes Turbotax Tax Tips Videos

17 Big Tax Deductions Write Offs For Businesses Bench Accounting